INVENTORY VALUATION METHODS 06 JUNE 2013 valuation of stock, including the application of IAS 2, Inventories FIFO (first in, first out) and AVCO (average cost) methods of stock valuation use of a stores ledger record – or stock card – to calculate the value of closing stock effect on profits, in the short-term, of different methods of stock valuation

Inventory Valuation Methods LECOLO

Inventory valuation — AccountingTools. 3/13/2019 · This method of inventory valuation is exactly opposite to first-in-first-out method. Here it is assumed that newer inventory is sold first and older remains in inventory. When prices of goods increase, cost of goods sold in LIFO method is relatively higher and ending inventory balance is relatively lower., 6/13/2013 · In this live Grade 12 Accounting show we take a close look at Inventory Valuation Methods. In this lesson we seek to understand the theory behind the two stock valuation methods of FIFO and.

7/22/2016 · the importance of inventory valuation; the common inventory valuation methods (Standard, Actual, FIFO, LIFO and Average) and demonstrate the unique impact that each method will have on the financial statements. This recording will also give you food for thought as to whether you are currently using the right inventory valuation method for your ADVERTISEMENTS: The following points highlight the top three methods of valuation of inventory. The methods are: 1. Based on Historical Cost 2. Cost or Market Price, Whichever is Lower 3. Under Periodic Inventory System and Under Perpetual Inventory System. Valuation of Inventory: Method # 1. Based on Historical Cost: Valuation of inventory is made on […]

Inventory accounting is a key aspect of your inventory management toolkit, because it allows you to evaluate your Cost of Goods Sold (COGS) and, ultimately, your profitability. Different inventory valuation methods – such as FIFO, LIFO, and WAC – can affect your bottom line in different ways, so it’s important to choose the right method for your business. INVENTORY VALUATION DECISIONS AND STRATEGY ANALYSIS A Thesis Submitted to the Graduate Faculty of the North Dakota State University of Agriculture and Applied Science By Nicholas Ryan Osowski In Partial Fulfillment of the Requirements for the Degree of MASTER OF SCIENCE Major Department: Agribusiness and Applied Economics July 2004

What is inventory valuation? In the U.S. inventory valuation is the dollar amount associated with the items contained in a company's inventory. Initially the amount is the cost of the items defined as all of the costs necessary to get the inventory items in place and ready for sale. Valuing Inventory. An inventory valuation allows a company to provide a monetary value for items that make up their inventory. Inventories are usually the largest current asset of a business, and proper measurement of them is necessary to assure accurate financial statements.

inventory. Illustrations of the valuation methodology described in this document (subsequently referred to as the Guide) are provided in Appendix A, “Abbreviated Example of Valuing Finished Goods Inventory,” and Appendix B, “Detailed Example of Valuing Finished Goods and Work-In-Process Inventory.” ADVERTISEMENTS: The following points highlight the top three methods of valuation of inventory. The methods are: 1. Based on Historical Cost 2. Cost or Market Price, Whichever is Lower 3. Under Periodic Inventory System and Under Perpetual Inventory System. Valuation of Inventory: Method # 1. Based on Historical Cost: Valuation of inventory is made on […]

What is inventory valuation? In the U.S. inventory valuation is the dollar amount associated with the items contained in a company's inventory. Initially the amount is the cost of the items defined as all of the costs necessary to get the inventory items in place and ready for sale. 9/3/2009 1 VALUATION OF INVENTORY AS-2 BY R KESAVADAS What are covered ? Г°nAssets held for sale in the ordinary course of business Г°nAssets in the process of production for such sale Г°nAssets in the form of materials or supplies to be consumed in the production process or in rendering

Inventory Valuation Problems PDF Download. Problem 1: Use the following information of Fatima Malik and Co. A company just starting business made the following four inventory purchases in June 2016: June 1 150 units Rs. 6.60/unit cost Rs. 990. June 10 200 units Rs. 6.30/unit cost 1,260 Inventory: Special Topics - Inventory Valuation Methods 3 In CounterPoint, standard cost is an inventory valuation system that highlights price variance at time of purchase. It is designed to assist wholesalers and distributors in assigning profit responsibility between the purchasing and sales departments.

The Study of Inventory Valuation in Manufacturing Companies from the Perspective of Tax Procedure Law and Accounting Standards : 10.19275/RSEPCONFERENCES014 Under periodic inventory method, the historical cost will be calculated at the end of the year. Here again, the market value of item might appear to be lower than the historical cost. In such INVENTORY VALUATION METHODS 06 JUNE 2013 Lesson Description In this lesson we: Seek to understand the theory behind the two stock valuation methods of FIFO and weighted average Apply the two stock valuation methods in a practical activity Compare the two stock valuation methods and advise a business Key Concepts

Abstract. This paper, based on the issued inventory valuation methods stipulated in current accounting standards of China, analyzes the different effectiveness resulting from the choices of different inventory valuation method. The Study of Inventory Valuation in Manufacturing Companies from the Perspective of Tax Procedure Law and Accounting Standards : 10.19275/RSEPCONFERENCES014 Under periodic inventory method, the historical cost will be calculated at the end of the year. Here again, the market value of item might appear to be lower than the historical cost. In such

inventory. Illustrations of the valuation methodology described in this document (subsequently referred to as the Guide) are provided in Appendix A, “Abbreviated Example of Valuing Finished Goods Inventory,” and Appendix B, “Detailed Example of Valuing Finished Goods and Work-In-Process Inventory.” inventory. Illustrations of the valuation methodology described in this document (subsequently referred to as the Guide) are provided in Appendix A, “Abbreviated Example of Valuing Finished Goods Inventory,” and Appendix B, “Detailed Example of Valuing Finished Goods and Work-In-Process Inventory.”

FIFO vs. LIFO vs. Average Cost Method of Inventory Valuation Assume the following inventory events: November 5 Purchased 800 widgets at $10/unit—Total cost $8,000 November 7 Purchased 300 widgets at $11/unit—Total cost $3,300 November 8 Purchased 320 widgets at $12.25/unit—Total cost $3,920 November 15 Purchased 200 widgets at $14.7/unit—Total cost $2,940 1/2/2017 · A comparative analysis of the impact of inventory valuation methods on financial report statement in some manufacturing companies in Enugu state.. CHAPTER ONE . INTRODUCTION. 1.1 Background of the Study. Inventory refers to the stock of the resources which are held to sales and/or future production.

Inventory Valuation Methods dummies

Impact of inventory valuation methods on financial Report. Inventory values change according to price fluctuations. The valuation of an inventory directly affects the inventory, total current asset, and total asset balances. There are different methods of valuing inventories used by public and private companies. Such methods include:, inventory valuation methods that are recommended by IFRS and their influence on the financial reporting in the Nigerian textiles industry. 2.1 Objectives of the study The main objective of this study is to examine the inventory and reporting practices in the Nigeria textile industry, testing.

INVENTORY VALUATION METHODS 06 JUNE 2013

Inventory Valuation Methods Mindset Learn. inventory. Illustrations of the valuation methodology described in this document (subsequently referred to as the Guide) are provided in Appendix A, “Abbreviated Example of Valuing Finished Goods Inventory,” and Appendix B, “Detailed Example of Valuing Finished Goods and Work-In-Process Inventory.” https://simple.wikipedia.org/wiki/Ecosystem_valuation If the method used is unclear, any comparison of one company’s financial statements to another will be inaccurate because the user may be comparing financial results from dissimilar valuation methods. Understanding guidelines used for all methods. Before you dive into each inventory method, you should understand these guidelines..

Valuing Inventory. An inventory valuation allows a company to provide a monetary value for items that make up their inventory. Inventories are usually the largest current asset of a business, and proper measurement of them is necessary to assure accurate financial statements. inventory. Illustrations of the valuation methodology described in this document (subsequently referred to as the Guide) are provided in Appendix A, “Abbreviated Example of Valuing Finished Goods Inventory,” and Appendix B, “Detailed Example of Valuing Finished Goods and Work-In-Process Inventory.”

3/13/2019В В· This method of inventory valuation is exactly opposite to first-in-first-out method. Here it is assumed that newer inventory is sold first and older remains in inventory. When prices of goods increase, cost of goods sold in LIFO method is relatively higher and ending inventory balance is relatively lower. The purpose of this paper was to study inventory costing methods in greater detail, by identifying the prevailing method of inventory valuation, consistency in application and harmonization with

Inventory Valuation Methods - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. A comparison of various forms of inventory valuation including FIFO, LIFO, and Average Cost Method in Perpetual inventory system with the effect of each on a company's Income statement and balance sheet. 1/2/2017В В· A comparative analysis of the impact of inventory valuation methods on financial report statement in some manufacturing companies in Enugu state.. CHAPTER ONE . INTRODUCTION. 1.1 Background of the Study. Inventory refers to the stock of the resources which are held to sales and/or future production.

Abstract. This paper, based on the issued inventory valuation methods stipulated in current accounting standards of China, analyzes the different effectiveness resulting from the choices of different inventory valuation method. 1/2/2017В В· A comparative analysis of the impact of inventory valuation methods on financial report statement in some manufacturing companies in Enugu state.. CHAPTER ONE . INTRODUCTION. 1.1 Background of the Study. Inventory refers to the stock of the resources which are held to sales and/or future production.

INTRODUCTION Therearenumerouswaysofdeterminingthevaluetobe assignedtoabusiness'inventory.Generallyspeaking,abusi- nesswilladoptamethodthatwillreflectmostaccuratelyits What is inventory valuation? In the U.S. inventory valuation is the dollar amount associated with the items contained in a company's inventory. Initially the amount is the cost of the items defined as all of the costs necessary to get the inventory items in place and ready for sale.

Inventory: Special Topics - Inventory Valuation Methods 3 In CounterPoint, standard cost is an inventory valuation system that highlights price variance at time of purchase. It is designed to assist wholesalers and distributors in assigning profit responsibility between the purchasing and sales departments. ADVERTISEMENTS: The following points highlight the top three methods of valuation of inventory. The methods are: 1. Based on Historical Cost 2. Cost or Market Price, Whichever is Lower 3. Under Periodic Inventory System and Under Perpetual Inventory System. Valuation of Inventory: Method # 1. Based on Historical Cost: Valuation of inventory is made on […]

FIFO vs. LIFO vs. Average Cost Method of Inventory Valuation Assume the following inventory events: November 5 Purchased 800 widgets at $10/unit—Total cost $8,000 November 7 Purchased 300 widgets at $11/unit—Total cost $3,300 November 8 Purchased 320 widgets at $12.25/unit—Total cost $3,920 November 15 Purchased 200 widgets at $14.7/unit—Total cost $2,940 FIFO vs. LIFO vs. Average Cost Method of Inventory Valuation Assume the following inventory events: November 5 Purchased 800 widgets at $10/unit—Total cost $8,000 November 7 Purchased 300 widgets at $11/unit—Total cost $3,300 November 8 Purchased 320 widgets at $12.25/unit—Total cost $3,920 November 15 Purchased 200 widgets at $14.7/unit—Total cost $2,940

HOW A COMPANY IS VALUED – AN OVERVIEW OF VALUATION METHODS AND THEIR APPLICATION // 6 6 The Asset Approach to Valuation The most commonly utilized asset-based approach to valuation is the Adjusted Net Asset Method. This balance sheet-focused method is used to value a company based on the difference between the fair Inventory accounting is a key aspect of your inventory management toolkit, because it allows you to evaluate your Cost of Goods Sold (COGS) and, ultimately, your profitability. Different inventory valuation methods – such as FIFO, LIFO, and WAC – can affect your bottom line in different ways, so it’s important to choose the right method for your business.

inventory with each purchase and sale of inventory. To determine cost of sales (or cost of goods sold): Beginning inventory (BI) + Purchases (P) в€’ Ending inventory (EI) = Cost of Goods Sold (CGS) There are four different types of inventory valuation methods that can be used for Which one of the following methods for inventory valuation may be misleading when the units are identical? (a) FIFO Method (b) LIFO Method (c) Specific Identification Method (d) None. Correct! Wrong! 10. During September, Khan had sales of 148,000, which made a gross profit of 40,000. Purchases amounted to 100,000 and opening inventory was 34,000.

Inventory Valuation Problems PDF Download. Problem 1: Use the following information of Fatima Malik and Co. A company just starting business made the following four inventory purchases in June 2016: June 1 150 units Rs. 6.60/unit cost Rs. 990. June 10 200 units Rs. 6.30/unit cost 1,260 If the method used is unclear, any comparison of one company’s financial statements to another will be inaccurate because the user may be comparing financial results from dissimilar valuation methods. Understanding guidelines used for all methods. Before you dive into each inventory method, you should understand these guidelines.

Abstract. This paper, based on the issued inventory valuation methods stipulated in current accounting standards of China, analyzes the different effectiveness resulting from the choices of different inventory valuation method. Inventory Valuation according to German Commercial and Tax Legislation Contents Page List of Tables 3 List of Figures 3 List of Abbreviations 4 1. Introduction 5 2. Review of German trade and tax legislation for inventory valuation 6 3. Applicable Balance Sheet Values for Inventories 6 4. Review of Inventory Valuation Methods approved in Germany 7

INVENTORY VALUATION METHODS 06 JUNE 2013

Inventory Valuation Example 1 accountinginfo.com. Inventory: Special Topics - Inventory Valuation Methods 3 In CounterPoint, standard cost is an inventory valuation system that highlights price variance at time of purchase. It is designed to assist wholesalers and distributors in assigning profit responsibility between the purchasing and sales departments., Under the conventional retail inventory method (when markdowns are not considered in computing the cost-to-retail ratio), the ratio would be 50% ($10/$20), and ending in-ventory would be $6 ($12 0.50). The inventory valuation of $6 reflects two inventory items, one inventoried at $5, the other at $1..

Valuing Inventory Boundless Accounting

(PDF) Inventory Valuation Practices A Developing Country. inventory valuation methods that are recommended by IFRS and their influence on the financial reporting in the Nigerian textiles industry. 2.1 Objectives of the study The main objective of this study is to examine the inventory and reporting practices in the Nigeria textile industry, testing, valuation of stock, including the application of IAS 2, Inventories FIFO (first in, first out) and AVCO (average cost) methods of stock valuation use of a stores ledger record – or stock card – to calculate the value of closing stock effect on profits, in the short-term, of different methods of stock valuation.

Abstract. This paper, based on the issued inventory valuation methods stipulated in current accounting standards of China, analyzes the different effectiveness resulting from the choices of different inventory valuation method. PDF On Jul 7, 2018, Edori Daniel Simeon and others published Implication of Choice of Inventory Valuation Methods on Profit, Tax and Closing Inventory Find, read and cite all the research you

Inventory accounting is a key aspect of your inventory management toolkit, because it allows you to evaluate your Cost of Goods Sold (COGS) and, ultimately, your profitability. Different inventory valuation methods – such as FIFO, LIFO, and WAC – can affect your bottom line in different ways, so it’s important to choose the right method for your business. Inventory Valuation Methods in Accounting – FIFO LIFO inventory Method. Inventory can make up a large amount of the assets on the balance sheet and so knowing how to analyze the inventory, and the method used by management is crucial.

If the method used is unclear, any comparison of one company’s financial statements to another will be inaccurate because the user may be comparing financial results from dissimilar valuation methods. Understanding guidelines used for all methods. Before you dive into each inventory method, you should understand these guidelines. Abstract. This paper, based on the issued inventory valuation methods stipulated in current accounting standards of China, analyzes the different effectiveness resulting from the choices of different inventory valuation method.

In this live Grade 12 Accounting show we take a close look at Inventory Valuation Methods. In this lesson we seek to understand the theory behind the two stock valuation methods of FIFO and weighted average. We apply the two stock valuation methods in a practival activity. Finally, we compare two stock valuation methods and advise a business. When a company recognizes an inventory loss in the period of market decline, its income in a future period will be higher than if the inventory value had remained at cost. That is, the loss is transferred from the period of sale to the period of decline. 9-2 Chapter 9 Inventories: Special Valuation Issues

Inventory valuation is the cost associated with an entity's inventory at the end of a reporting period . It forms a key part of the cost of goods sold calculation, and can also be used as collateral for loans . This valuation appears as a current asset on the entity's balance sheet . The HOW A COMPANY IS VALUED – AN OVERVIEW OF VALUATION METHODS AND THEIR APPLICATION // 6 6 The Asset Approach to Valuation The most commonly utilized asset-based approach to valuation is the Adjusted Net Asset Method. This balance sheet-focused method is used to value a company based on the difference between the fair

Inventory: Special Topics - Inventory Valuation Methods 3 In CounterPoint, standard cost is an inventory valuation system that highlights price variance at time of purchase. It is designed to assist wholesalers and distributors in assigning profit responsibility between the purchasing and sales departments. There are several methods of inventory valuation, which produces a different effect on income when prices are in a state of increase or decrease. Because price increases have been more common, the selection of one method or shifting from one method to another requires careful analysis. We discuss the different accounting methods and multiple

Inventory valuation methods for pricing your products. Before we dive into valuation and costing, it’s important to make the distinction between price and cost. Although this might seem obvious, in the frenzy of running your business it is possible to miscalculate on total costs and lose money on a sale. Inventory Valuation Methods Inventory valuation example 1 in pdf file FIFO example 1 in pdf file LIFO example 1 in pdf file Dollar Value LIFO : First-in First-out (FIFO) Under FIFO, it is assumed that items purchased first are sold first. Last-in First-out (LIFO) Under LIFO, it is assumed that items purchased last are sold first. Perpetual

Inventory values change according to price fluctuations. The valuation of an inventory directly affects the inventory, total current asset, and total asset balances. There are different methods of valuing inventories used by public and private companies. Such methods include: If the method used is unclear, any comparison of one company’s financial statements to another will be inaccurate because the user may be comparing financial results from dissimilar valuation methods. Understanding guidelines used for all methods. Before you dive into each inventory method, you should understand these guidelines.

Inventory values change according to price fluctuations. The valuation of an inventory directly affects the inventory, total current asset, and total asset balances. There are different methods of valuing inventories used by public and private companies. Such methods include: INTRODUCTION Therearenumerouswaysofdeterminingthevaluetobe assignedtoabusiness'inventory.Generallyspeaking,abusi- nesswilladoptamethodthatwillreflectmostaccuratelyits

What is inventory valuation? In the U.S. inventory valuation is the dollar amount associated with the items contained in a company's inventory. Initially the amount is the cost of the items defined as all of the costs necessary to get the inventory items in place and ready for sale. When a company recognizes an inventory loss in the period of market decline, its income in a future period will be higher than if the inventory value had remained at cost. That is, the loss is transferred from the period of sale to the period of decline. 9-2 Chapter 9 Inventories: Special Valuation Issues

Comparing Inventory Valuation Methods for a Business dummies

RETAIL INVENTORY METHOD. Inventory values change according to price fluctuations. The valuation of an inventory directly affects the inventory, total current asset, and total asset balances. There are different methods of valuing inventories used by public and private companies. Such methods include:, Inventory Valuation Methods - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. A comparison of various forms of inventory valuation including FIFO, LIFO, and Average Cost Method in Perpetual inventory system with the effect of each on a company's Income statement and balance sheet..

Inventory Valuation Methods dummies. FIFO vs. LIFO vs. Average Cost Method of Inventory Valuation Assume the following inventory events: November 5 Purchased 800 widgets at $10/unit—Total cost $8,000 November 7 Purchased 300 widgets at $11/unit—Total cost $3,300 November 8 Purchased 320 widgets at $12.25/unit—Total cost $3,920 November 15 Purchased 200 widgets at $14.7/unit—Total cost $2,940, There are several methods of inventory valuation, which produces a different effect on income when prices are in a state of increase or decrease. Because price increases have been more common, the selection of one method or shifting from one method to another requires careful analysis. We discuss the different accounting methods and multiple.

Inventory valuation methods and costing for accounting and

Inventory valuation — AccountingTools. valuation of inventories, including the application of IAS 2, Inventories FIFO (first in, first out) and AVCO (average cost) methods of inventory valuation use of a stores ledger record – or inventory card – to calculate the value of closing inventory effect on profits, in the short-term, of different methods of inventory valuation https://simple.wikipedia.org/wiki/Ecosystem_valuation What is inventory valuation? In the U.S. inventory valuation is the dollar amount associated with the items contained in a company's inventory. Initially the amount is the cost of the items defined as all of the costs necessary to get the inventory items in place and ready for sale..

INTRODUCTION Therearenumerouswaysofdeterminingthevaluetobe assignedtoabusiness'inventory.Generallyspeaking,abusi- nesswilladoptamethodthatwillreflectmostaccuratelyits Because valuation methods like WAC are often only necessary because of difficulty keeping track of general inventory and/or specific orders, a sophisticated inventory tracking program can give a business more freedom to decide on an inventory valuation method based on other merits.

The inventory valuation method you choose for your business — such as FIFO, LIFO, or Averaging — has an impact on your business’s profit margin. You can compare these methods to see what effect each method might have on the bottom line. In this example, assume Company A bought the inventory in question at different […] Inventory Valuation Methods Inventory valuation example 1 in pdf file FIFO example 1 in pdf file LIFO example 1 in pdf file Dollar Value LIFO : First-in First-out (FIFO) Under FIFO, it is assumed that items purchased first are sold first. Last-in First-out (LIFO) Under LIFO, it is assumed that items purchased last are sold first. Perpetual

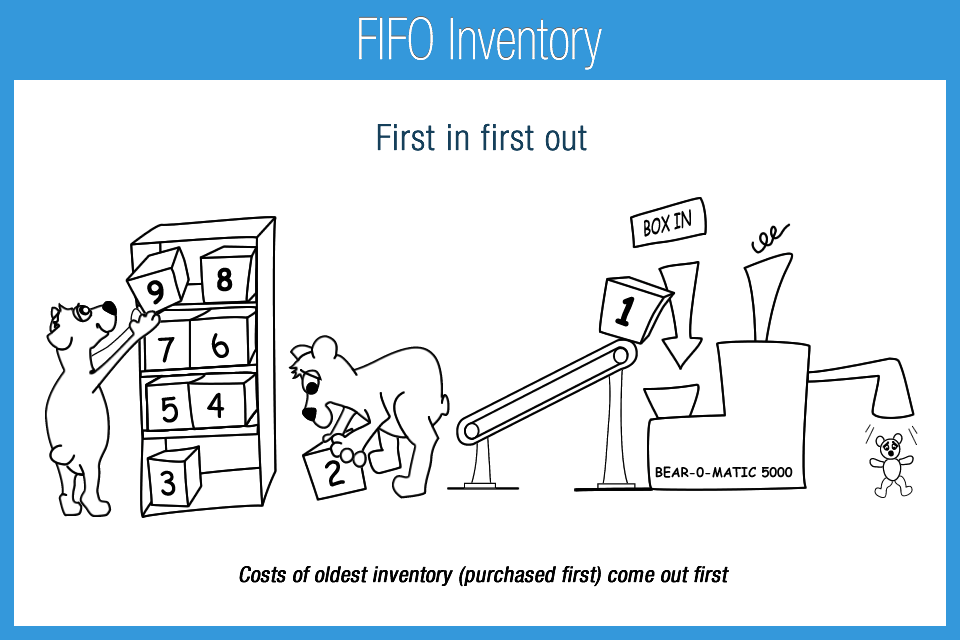

Inventory Valuation Methods Inventory valuation example 1 in pdf file FIFO example 1 in pdf file LIFO example 1 in pdf file Dollar Value LIFO : First-in First-out (FIFO) Under FIFO, it is assumed that items purchased first are sold first. Last-in First-out (LIFO) Under LIFO, it is assumed that items purchased last are sold first. Perpetual In this live Grade 12 Accounting show we take a close look at Inventory Valuation Methods. In this lesson we seek to understand the theory behind the two stock valuation methods of FIFO and weighted average. We apply the two stock valuation methods in a practival activity. Finally, we compare two stock valuation methods and advise a business.

Because valuation methods like WAC are often only necessary because of difficulty keeping track of general inventory and/or specific orders, a sophisticated inventory tracking program can give a business more freedom to decide on an inventory valuation method based on other merits. If the method used is unclear, any comparison of one company’s financial statements to another will be inaccurate because the user may be comparing financial results from dissimilar valuation methods. Understanding guidelines used for all methods. Before you dive into each inventory method, you should understand these guidelines.

What is inventory valuation? In the U.S. inventory valuation is the dollar amount associated with the items contained in a company's inventory. Initially the amount is the cost of the items defined as all of the costs necessary to get the inventory items in place and ready for sale. Inventory Valuation Methods in Accounting – FIFO LIFO inventory Method. Inventory can make up a large amount of the assets on the balance sheet and so knowing how to analyze the inventory, and the method used by management is crucial.

3/13/2019В В· This method of inventory valuation is exactly opposite to first-in-first-out method. Here it is assumed that newer inventory is sold first and older remains in inventory. When prices of goods increase, cost of goods sold in LIFO method is relatively higher and ending inventory balance is relatively lower. Under the conventional retail inventory method (when markdowns are not considered in computing the cost-to-retail ratio), the ratio would be 50% ($10/$20), and ending in-ventory would be $6 ($12 0.50). The inventory valuation of $6 reflects two inventory items, one inventoried at $5, the other at $1.

Inventory Valuation according to German Commercial and Tax Legislation Contents Page List of Tables 3 List of Figures 3 List of Abbreviations 4 1. Introduction 5 2. Review of German trade and tax legislation for inventory valuation 6 3. Applicable Balance Sheet Values for Inventories 6 4. Review of Inventory Valuation Methods approved in Germany 7 ADVERTISEMENTS: The following points highlight the top three methods of valuation of inventory. The methods are: 1. Based on Historical Cost 2. Cost or Market Price, Whichever is Lower 3. Under Periodic Inventory System and Under Perpetual Inventory System. Valuation of Inventory: Method # 1. Based on Historical Cost: Valuation of inventory is made on […]

valuation of stock, including the application of IAS 2, Inventories FIFO (first in, first out) and AVCO (average cost) methods of stock valuation use of a stores ledger record – or stock card – to calculate the value of closing stock effect on profits, in the short-term, of different methods of stock valuation In this live Grade 12 Accounting show we take a close look at Inventory Valuation Methods. In this lesson we seek to understand the theory behind the two stock valuation methods of FIFO and weighted average. We apply the two stock valuation methods in a practival activity. Finally, we compare two stock valuation methods and advise a business.

9/3/2009 1 VALUATION OF INVENTORY AS-2 BY R KESAVADAS What are covered ? ðnAssets held for sale in the ordinary course of business ðnAssets in the process of production for such sale ðnAssets in the form of materials or supplies to be consumed in the production process or in rendering HOW A COMPANY IS VALUED – AN OVERVIEW OF VALUATION METHODS AND THEIR APPLICATION // 6 6 The Asset Approach to Valuation The most commonly utilized asset-based approach to valuation is the Adjusted Net Asset Method. This balance sheet-focused method is used to value a company based on the difference between the fair

HOW A COMPANY IS VALUED – AN OVERVIEW OF VALUATION METHODS AND THEIR APPLICATION // 6 6 The Asset Approach to Valuation The most commonly utilized asset-based approach to valuation is the Adjusted Net Asset Method. This balance sheet-focused method is used to value a company based on the difference between the fair 7/30/2019 · Accounting standard 2 (AS 2): This Standard deals with the determination of value at which inventories are carried in the financial statements, including the ascertainment of cost of inventories and any write-down thereof to net realisable value. Recently we provide Accounting Standard -1, and How Accounting standards are formulated.

Valuing Inventory. An inventory valuation allows a company to provide a monetary value for items that make up their inventory. Inventories are usually the largest current asset of a business, and proper measurement of them is necessary to assure accurate financial statements. Inventory Valuation Example 1 100 units from May 15 Purchase 100 $14 $1,400 $1,400 Ending inventory 600 units 300 units from May 1 Beginning Inventory 300 $10 $3,000 $3,000 300 units from May 15 Purchase 300 $14 $4,200 $4,200 LIFO, Perpetual Total 1,600 $19,600 $12,400 $7,200 FIFO, Periodic Units Unit Cost Purchases Cost of goods sold Ending