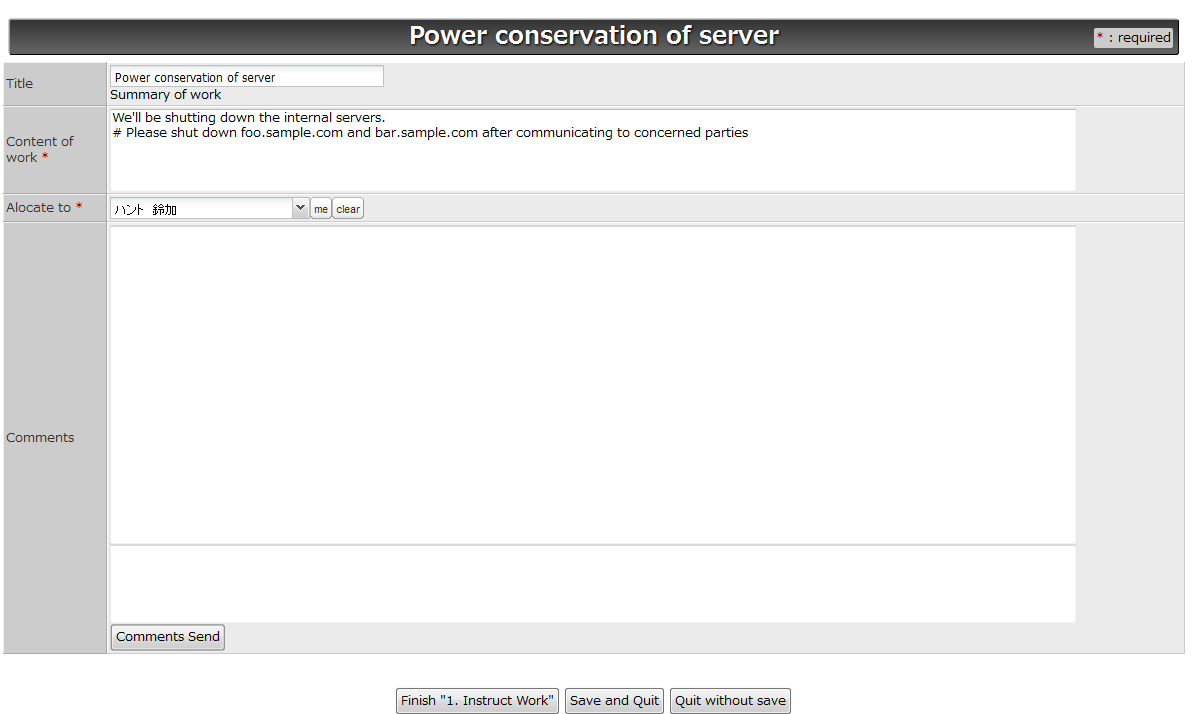

Job instruction form Wellington

Instructions For Completing Payroll Form WH-347 Wage Application for Permanent Employment Certification ETA Form 9089 - Instructions U.S. Department of Labor OMB Approval: 1205-0451 Expiration Date: 05/31/2021 Instructions for ETA Form 9089 Page 4 of 11 . Section E. Agent or Attorney Information. This information must be different than the employer contact information entered in Section D. 1.

www.ironore.ca

Expiration Date 05/31/2021 Labor certification. Job Corps Forms Single Instance Provides instructions about filling out the Job Corps Health History Form. Job Corps Immunization Record. Used to document the cumulative immunization status of a student. Job Corps Oral Examination Record., Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 2020 11/04/2019 Inst 1099-B: Instructions for Form 1099-B, Proceeds from Broker and Barter Exchange Transactions 2018 02/05/2019 Inst 1099-B.

If you qualify for the job, your application will be forwarded to the nominating official, who will contact you for an interview. (For ARNG jobs, if there are more than 10 qualified applicants, a job panel will be convened first.) If you do not qualify for the job, you will receive a letter of notification. Application for Permanent Employment Certification ETA Form 9089 - Instructions U.S. Department of Labor OMB Approval: 1205-0451 Expiration Date: 05/31/2021 Instructions for ETA Form 9089 Page 4 of 11 . Section E. Agent or Attorney Information. This information must be different than the employer contact information entered in Section D. 1.

> Tips to Write Instruction Sheet Template. When you are about to write the instruction sheet, you will find this template quite easy as it is a simple listing down of the elements that will help to execute a task in a proper step by step manner. Though in some instances, you might find it a little monotonous. 4 2018 IT-203-I, General information Accessourwebsiteatwww.tax.ny.gov • Hire a veteran credit This credit was extended through December 31, 2020. See Form IT-643, Hire a Veteran Credit, and its instructions. • New York youth jobs program tax credit Beginning …

Job application forms (also called “employment forms”) are part of the formal hiring process companies sometimes use in order to ensure that they have gathered comprehensive, accurate data from all … Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 2020 11/04/2019 Inst 1099-B: Instructions for Form 1099-B, Proceeds from Broker and Barter Exchange Transactions 2018 02/05/2019 Inst 1099-B

Instructions For Completing Payroll Form, WH-347. WH-347 (PDF) OMB Control No. 1235-0008, Expires 04/30/2021. General: Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. . Properly filled out, this form will satisfy the requirements of TWI: Job Instruction (1 Day Class) Standard work is widely recognized as a cornerstone of the lean transformation. Each successful completion of a standard task validates the hypothesis that the work is properly designed, that the worker is adequately trained, and that operating conditions are normal.

The Taxpayer Advocate Service Is Here To Help You : What is the Taxpayer Advocate Service? The Taxpayer Advocate Service (TAS) is an independent organization within the Internal Revenue Service (IRS) that helps taxpayers and protects taxpayer rights. Our job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. Work Instructions Template. A standard Work Instruction is vital in ensuring that all tasks in the job is completed correctly and safely and is part of the overall quality management system in an organisation ensuring product quality for the end customer.

Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 2020 11/04/2019 Inst 1099-B: Instructions for Form 1099-B, Proceeds from Broker and Barter Exchange Transactions 2018 02/05/2019 Inst 1099-B *Prior to finalization, many of the major Wisconsin income and franchise tax forms and instructions are available as advance drafts. Note: These advance draft items are not final and are subject to change at any time. March 23, 2015

STANDARD FORM 100, REV. March 2018, EMPLOYER INFORMATION REPORT EEO-1. INSTRUCTION BOOKLET. The Employer Information EEO-1 report (Standard Form 100) is collected annually under the authority of Title VII of the Civil Rights Act of 1964, 42 U.S.C. 2000e, et. seq., as amended. 4 2018 IT-203-I, General information Accessourwebsiteatwww.tax.ny.gov • Hire a veteran credit This credit was extended through December 31, 2020. See Form IT-643, Hire a Veteran Credit, and its instructions. • New York youth jobs program tax credit Beginning …

Item 9 – Other job-related requirements for this position – Indicate job-related requirements, if any, that are not elsewhere listed on the position description (e.g., Driver’s License). Item 10 – Working hours – To be completed if required by the employing agency. Item 11 – Agency Use Only - … A work instruction – or work guide, job aid or standard operating procedure – describes in detail how an activity within a process (or procedure) is performed. Your work instruction should therefore be part of an overall process improvement plan. With this clarity let’s move on to the topic of how to write work instructions.

A work instruction – or work guide, job aid or standard operating procedure – describes in detail how an activity within a process (or procedure) is performed. Your work instruction should therefore be part of an overall process improvement plan. With this clarity let’s move on to the topic of how to write work instructions. Job application forms (also called “employment forms”) are part of the formal hiring process companies sometimes use in order to ensure that they have gathered comprehensive, accurate data from all …

Instructions For Completing Payroll Form, WH-347. WH-347 (PDF) OMB Control No. 1235-0008, Expires 04/30/2021. General: Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. . Properly filled out, this form will satisfy the requirements of TWI: Job Instruction (1 Day Class) Standard work is widely recognized as a cornerstone of the lean transformation. Each successful completion of a standard task validates the hypothesis that the work is properly designed, that the worker is adequately trained, and that operating conditions are normal.

PW1 User Guide New York City

EEO-1 Instruction Booklet eeoc.gov. Form SSA-7163 (03-2014) EF (03-2014) Destroy Prior Editions. We estimate that it will take you about 12 minutes to read the instructions, gather the necessary facts and answer the questions. Questionnaire about employment or self-employment outside the United States, employment, self-employment, outside the United States, SSA-7163, 7163, Information On Release Of IRS Form 990-N As outlined in the AGO’s recently updated Form PC Instructions (2018 Update), all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements. We accept IRS Forms 990, 990-EZ, 990-PF, 1120 and 1041..

Form PC Instructions and Extensions Mass.gov

AGR Application Instructions. Job Corps Forms Single Instance Provides instructions about filling out the Job Corps Health History Form. Job Corps Immunization Record. Used to document the cumulative immunization status of a student. Job Corps Oral Examination Record. *Prior to finalization, many of the major Wisconsin income and franchise tax forms and instructions are available as advance drafts. Note: These advance draft items are not final and are subject to change at any time. March 23, 2015.

STANDARD FORM 100, REV. March 2018, EMPLOYER INFORMATION REPORT EEO-1. INSTRUCTION BOOKLET. The Employer Information EEO-1 report (Standard Form 100) is collected annually under the authority of Title VII of the Civil Rights Act of 1964, 42 U.S.C. 2000e, et. seq., as amended. Oct 18, 2018 · Job Search. If you used the job cart to select the positions of interest you can skip the job search step. If you wish to add, delete or select different positions once you have begun the application please use the job search function in the application. You can search for positions by “Category” (e.g., engineering, analysis).

Oct 18, 2018 · Job Search. If you used the job cart to select the positions of interest you can skip the job search step. If you wish to add, delete or select different positions once you have begun the application please use the job search function in the application. You can search for positions by “Category” (e.g., engineering, analysis). Form BD . Uniform Application for Broker-Dealer Registration . SEC1490 (1-08) a currently valid OMB control number. FORM BD INSTRUCTIONS A. GENERAL INSTRUCTIONS . 1. Form BD is the Uniform Application for Broker-Dealer Registration. Broker-Dealers must file this form to register with the Securities and Exchange Commission, the

Work Instructions Template. A standard Work Instruction is vital in ensuring that all tasks in the job is completed correctly and safely and is part of the overall quality management system in an organisation ensuring product quality for the end customer. Fees to employment agencies and other costs to look for a new job in your present occupation, even if you don't get a new job. Certain business use of part of your home. For details, including limits that apply, use TaxTopic 509 (see the Instructions for Form 1040) or see Pub. 587. Certain educational expenses.

Instructions For Completing Payroll Form, WH-347. WH-347 (PDF) OMB Control No. 1235-0008, Expires 04/30/2021. General: Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. . Properly filled out, this form will satisfy the requirements of Item 9 – Other job-related requirements for this position – Indicate job-related requirements, if any, that are not elsewhere listed on the position description (e.g., Driver’s License). Item 10 – Working hours – To be completed if required by the employing agency. Item 11 – Agency Use Only - …

The Taxpayer Advocate Service Is Here To Help You : What is the Taxpayer Advocate Service? The Taxpayer Advocate Service (TAS) is an independent organization within the Internal Revenue Service (IRS) that helps taxpayers and protects taxpayer rights. Our job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. *Prior to finalization, many of the major Wisconsin income and franchise tax forms and instructions are available as advance drafts. Note: These advance draft items are not final and are subject to change at any time. March 23, 2015

STANDARD FORM 100, REV. March 2018, EMPLOYER INFORMATION REPORT EEO-1. INSTRUCTION BOOKLET. The Employer Information EEO-1 report (Standard Form 100) is collected annually under the authority of Title VII of the Civil Rights Act of 1964, 42 U.S.C. 2000e, et. seq., as amended. Information On Release Of IRS Form 990-N As outlined in the AGO’s recently updated Form PC Instructions (2018 Update), all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements. We accept IRS Forms 990, 990-EZ, 990-PF, 1120 and 1041.

Fees to employment agencies and other costs to look for a new job in your present occupation, even if you don't get a new job. Certain business use of part of your home. For details, including limits that apply, use TaxTopic 509 (see the Instructions for Form 1040) or see Pub. 587. Certain educational expenses. Form SSA-7163 (03-2014) EF (03-2014) Destroy Prior Editions. We estimate that it will take you about 12 minutes to read the instructions, gather the necessary facts and answer the questions. Questionnaire about employment or self-employment outside the United States, employment, self-employment, outside the United States, SSA-7163, 7163

Form BD . Uniform Application for Broker-Dealer Registration . SEC1490 (1-08) a currently valid OMB control number. FORM BD INSTRUCTIONS A. GENERAL INSTRUCTIONS . 1. Form BD is the Uniform Application for Broker-Dealer Registration. Broker-Dealers must file this form to register with the Securities and Exchange Commission, the Oct 18, 2018 · Job Search. If you used the job cart to select the positions of interest you can skip the job search step. If you wish to add, delete or select different positions once you have begun the application please use the job search function in the application. You can search for positions by “Category” (e.g., engineering, analysis).

4 2018 IT-203-I, General information Accessourwebsiteatwww.tax.ny.gov • Hire a veteran credit This credit was extended through December 31, 2020. See Form IT-643, Hire a Veteran Credit, and its instructions. • New York youth jobs program tax credit Beginning … The forms below are used to indicate special tax options: Domestic Employer's Election Form - (Form C-20) indicates election by a domestic-only employer to report quarterly wages and pay taxes on an annual basis.; Domestic Employer's Revocation Form - (Form C-20F) revokes a previous election by a domestic-only employer to report quarterly wages and pay taxes on an annual basis.

4 2018 IT-203-I, General information Accessourwebsiteatwww.tax.ny.gov • Hire a veteran credit This credit was extended through December 31, 2020. See Form IT-643, Hire a Veteran Credit, and its instructions. • New York youth jobs program tax credit Beginning … DoD Issuances Web site combines all DOD Instructions, publications and directives. This site does not include forms. Department of the Navy Issuance

The forms below are used to indicate special tax options: Domestic Employer's Election Form - (Form C-20) indicates election by a domestic-only employer to report quarterly wages and pay taxes on an annual basis.; Domestic Employer's Revocation Form - (Form C-20F) revokes a previous election by a domestic-only employer to report quarterly wages and pay taxes on an annual basis. PERFORMANCE EVALUATION INSTRUCTIONS CTCD Performance Evaluation Instructions (Rev. 1/13) 2 . Generally speaking, such factors as the length of time that the employee has been in the job, some unusual business, or individual situation that may have arisen during the performance review periods,hould not affect the ratings determination.

Tax Forms & Instructions Texas Workforce Commission

PW1 User Guide New York City. If you qualify for the job, your application will be forwarded to the nominating official, who will contact you for an interview. (For ARNG jobs, if there are more than 10 qualified applicants, a job panel will be convened first.) If you do not qualify for the job, you will receive a letter of notification., DoD Issuances Web site combines all DOD Instructions, publications and directives. This site does not include forms. Department of the Navy Issuance.

Questionnaire about Employment or Self-Employment outside

Questionnaire about Employment or Self-Employment outside. A work instruction – or work guide, job aid or standard operating procedure – describes in detail how an activity within a process (or procedure) is performed. Your work instruction should therefore be part of an overall process improvement plan. With this clarity let’s move on to the topic of how to write work instructions., DoD Issuances Web site combines all DOD Instructions, publications and directives. This site does not include forms. Department of the Navy Issuance.

Item 9 – Other job-related requirements for this position – Indicate job-related requirements, if any, that are not elsewhere listed on the position description (e.g., Driver’s License). Item 10 – Working hours – To be completed if required by the employing agency. Item 11 – Agency Use Only - … PERFORMANCE EVALUATION INSTRUCTIONS CTCD Performance Evaluation Instructions (Rev. 1/13) 2 . Generally speaking, such factors as the length of time that the employee has been in the job, some unusual business, or individual situation that may have arisen during the performance review periods,hould not affect the ratings determination.

A work instruction – or work guide, job aid or standard operating procedure – describes in detail how an activity within a process (or procedure) is performed. Your work instruction should therefore be part of an overall process improvement plan. With this clarity let’s move on to the topic of how to write work instructions. Instructions For Completing Payroll Form, WH-347. WH-347 (PDF) OMB Control No. 1235-0008, Expires 04/30/2021. General: Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. . Properly filled out, this form will satisfy the requirements of

Form SSA-7163 (03-2014) EF (03-2014) Destroy Prior Editions. We estimate that it will take you about 12 minutes to read the instructions, gather the necessary facts and answer the questions. Questionnaire about employment or self-employment outside the United States, employment, self-employment, outside the United States, SSA-7163, 7163 The forms below are used to indicate special tax options: Domestic Employer's Election Form - (Form C-20) indicates election by a domestic-only employer to report quarterly wages and pay taxes on an annual basis.; Domestic Employer's Revocation Form - (Form C-20F) revokes a previous election by a domestic-only employer to report quarterly wages and pay taxes on an annual basis.

This document provides information for use when filling out the PW1 form. It includes general template information the Department of Buildings forms follow as well specific instructions on certain PW1 sections. New users are encouraged to read this prior to completing the PW1. this section of the form. Only one job type and any associated PERFORMANCE EVALUATION INSTRUCTIONS CTCD Performance Evaluation Instructions (Rev. 1/13) 2 . Generally speaking, such factors as the length of time that the employee has been in the job, some unusual business, or individual situation that may have arisen during the performance review periods,hould not affect the ratings determination.

> Tips to Write Instruction Sheet Template. When you are about to write the instruction sheet, you will find this template quite easy as it is a simple listing down of the elements that will help to execute a task in a proper step by step manner. Though in some instances, you might find it a little monotonous. Instructions For Completing Payroll Form, WH-347. WH-347 (PDF) OMB Control No. 1235-0008, Expires 04/30/2021. General: Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. . Properly filled out, this form will satisfy the requirements of

> Tips to Write Instruction Sheet Template. When you are about to write the instruction sheet, you will find this template quite easy as it is a simple listing down of the elements that will help to execute a task in a proper step by step manner. Though in some instances, you might find it a little monotonous. Application for Permanent Employment Certification ETA Form 9089 - Instructions U.S. Department of Labor OMB Approval: 1205-0451 Expiration Date: 05/31/2021 Instructions for ETA Form 9089 Page 4 of 11 . Section E. Agent or Attorney Information. This information must be different than the employer contact information entered in Section D. 1.

Form SSA-7163 (03-2014) EF (03-2014) Destroy Prior Editions. We estimate that it will take you about 12 minutes to read the instructions, gather the necessary facts and answer the questions. Questionnaire about employment or self-employment outside the United States, employment, self-employment, outside the United States, SSA-7163, 7163 TWI: Job Instruction (1 Day Class) Standard work is widely recognized as a cornerstone of the lean transformation. Each successful completion of a standard task validates the hypothesis that the work is properly designed, that the worker is adequately trained, and that operating conditions are normal.

Form SSA-7163 (03-2014) EF (03-2014) Destroy Prior Editions. We estimate that it will take you about 12 minutes to read the instructions, gather the necessary facts and answer the questions. Questionnaire about employment or self-employment outside the United States, employment, self-employment, outside the United States, SSA-7163, 7163 Oct 18, 2018 · Job Search. If you used the job cart to select the positions of interest you can skip the job search step. If you wish to add, delete or select different positions once you have begun the application please use the job search function in the application. You can search for positions by “Category” (e.g., engineering, analysis).

Form BD . Uniform Application for Broker-Dealer Registration . SEC1490 (1-08) a currently valid OMB control number. FORM BD INSTRUCTIONS A. GENERAL INSTRUCTIONS . 1. Form BD is the Uniform Application for Broker-Dealer Registration. Broker-Dealers must file this form to register with the Securities and Exchange Commission, the Fees to employment agencies and other costs to look for a new job in your present occupation, even if you don't get a new job. Certain business use of part of your home. For details, including limits that apply, use TaxTopic 509 (see the Instructions for Form 1040) or see Pub. 587. Certain educational expenses.

A work instruction – or work guide, job aid or standard operating procedure – describes in detail how an activity within a process (or procedure) is performed. Your work instruction should therefore be part of an overall process improvement plan. With this clarity let’s move on to the topic of how to write work instructions. This document provides information for use when filling out the PW1 form. It includes general template information the Department of Buildings forms follow as well specific instructions on certain PW1 sections. New users are encouraged to read this prior to completing the PW1. this section of the form. Only one job type and any associated

Expiration Date 05/31/2021 Labor certification

Forms Directives and Instructions. Military Reuse Zone Credit - Distribution to Partners of a Partnership (For instructions, see 306 instructions) Tax Credits Forms : 306-S : Military Reuse Zone Credit - Distribution to Shareholders of an S Corporation (For instructions, see 306 instructions) Tax Credits Forms, PERFORMANCE EVALUATION INSTRUCTIONS CTCD Performance Evaluation Instructions (Rev. 1/13) 2 . Generally speaking, such factors as the length of time that the employee has been in the job, some unusual business, or individual situation that may have arisen during the performance review periods,hould not affect the ratings determination..

Tax Credits Forms Arizona Department of Revenue

www.ironore.ca. > Tips to Write Instruction Sheet Template. When you are about to write the instruction sheet, you will find this template quite easy as it is a simple listing down of the elements that will help to execute a task in a proper step by step manner. Though in some instances, you might find it a little monotonous. Military Reuse Zone Credit - Distribution to Partners of a Partnership (For instructions, see 306 instructions) Tax Credits Forms : 306-S : Military Reuse Zone Credit - Distribution to Shareholders of an S Corporation (For instructions, see 306 instructions) Tax Credits Forms.

Information On Release Of IRS Form 990-N As outlined in the AGO’s recently updated Form PC Instructions (2018 Update), all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements. We accept IRS Forms 990, 990-EZ, 990-PF, 1120 and 1041. 4 2018 IT-203-I, General information Accessourwebsiteatwww.tax.ny.gov • Hire a veteran credit This credit was extended through December 31, 2020. See Form IT-643, Hire a Veteran Credit, and its instructions. • New York youth jobs program tax credit Beginning …

Instructions For Completing Payroll Form, WH-347. WH-347 (PDF) OMB Control No. 1235-0008, Expires 04/30/2021. General: Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. . Properly filled out, this form will satisfy the requirements of Success of the instructor is based on success of the learner on the job. The Job Breakdown. A Job Breakdown is created before instruction is attempted. The instructor goes to the where the job is being done and captures the important steps, and the key points and reasons for each key point on a Job Breakdown Form. An important step is any

Information On Release Of IRS Form 990-N As outlined in the AGO’s recently updated Form PC Instructions (2018 Update), all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements. We accept IRS Forms 990, 990-EZ, 990-PF, 1120 and 1041. Information On Release Of IRS Form 990-N As outlined in the AGO’s recently updated Form PC Instructions (2018 Update), all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements. We accept IRS Forms 990, 990-EZ, 990-PF, 1120 and 1041.

STANDARD FORM 100, REV. March 2018, EMPLOYER INFORMATION REPORT EEO-1. INSTRUCTION BOOKLET. The Employer Information EEO-1 report (Standard Form 100) is collected annually under the authority of Title VII of the Civil Rights Act of 1964, 42 U.S.C. 2000e, et. seq., as amended. Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 2020 11/04/2019 Inst 1099-B: Instructions for Form 1099-B, Proceeds from Broker and Barter Exchange Transactions 2018 02/05/2019 Inst 1099-B

Job application forms (also called “employment forms”) are part of the formal hiring process companies sometimes use in order to ensure that they have gathered comprehensive, accurate data from all … Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 2020 11/04/2019 Inst 1099-B: Instructions for Form 1099-B, Proceeds from Broker and Barter Exchange Transactions 2018 02/05/2019 Inst 1099-B

Form SSA-7163 (03-2014) EF (03-2014) Destroy Prior Editions. We estimate that it will take you about 12 minutes to read the instructions, gather the necessary facts and answer the questions. Questionnaire about employment or self-employment outside the United States, employment, self-employment, outside the United States, SSA-7163, 7163 DoD Issuances Web site combines all DOD Instructions, publications and directives. This site does not include forms. Department of the Navy Issuance

Item 9 – Other job-related requirements for this position – Indicate job-related requirements, if any, that are not elsewhere listed on the position description (e.g., Driver’s License). Item 10 – Working hours – To be completed if required by the employing agency. Item 11 – Agency Use Only - … Job Corps Forms Single Instance Provides instructions about filling out the Job Corps Health History Form. Job Corps Immunization Record. Used to document the cumulative immunization status of a student. Job Corps Oral Examination Record.

Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 2020 11/04/2019 Inst 1099-B: Instructions for Form 1099-B, Proceeds from Broker and Barter Exchange Transactions 2018 02/05/2019 Inst 1099-B Form BD . Uniform Application for Broker-Dealer Registration . SEC1490 (1-08) a currently valid OMB control number. FORM BD INSTRUCTIONS A. GENERAL INSTRUCTIONS . 1. Form BD is the Uniform Application for Broker-Dealer Registration. Broker-Dealers must file this form to register with the Securities and Exchange Commission, the

Job application forms (also called “employment forms”) are part of the formal hiring process companies sometimes use in order to ensure that they have gathered comprehensive, accurate data from all … Information On Release Of IRS Form 990-N As outlined in the AGO’s recently updated Form PC Instructions (2018 Update), all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements. We accept IRS Forms 990, 990-EZ, 990-PF, 1120 and 1041.

TWI: Job Instruction (1 Day Class) Standard work is widely recognized as a cornerstone of the lean transformation. Each successful completion of a standard task validates the hypothesis that the work is properly designed, that the worker is adequately trained, and that operating conditions are normal. Work Instructions Template. A standard Work Instruction is vital in ensuring that all tasks in the job is completed correctly and safely and is part of the overall quality management system in an organisation ensuring product quality for the end customer.

Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 2020 11/04/2019 Inst 1099-B: Instructions for Form 1099-B, Proceeds from Broker and Barter Exchange Transactions 2018 02/05/2019 Inst 1099-B Application for Permanent Employment Certification ETA Form 9089 - Instructions U.S. Department of Labor OMB Approval: 1205-0451 Expiration Date: 05/31/2021 Instructions for ETA Form 9089 Page 4 of 11 . Section E. Agent or Attorney Information. This information must be different than the employer contact information entered in Section D. 1.